How a Certified Wealth Counselor™ Connects the Relational and the Technical

A Certified Wealth Counselor™ differs markedly from other wealth advisers because of the deep commitment to connecting the relational and the technical. Many wealth management and financial planning firms advertise that they care about the client's vision, values, and other spiritual ideals. Few, however, can explain how dreamy rhetoric translates into advanced planning documents. This is because only a small minority of wealth managers have fully understood or applied the wealth counseling concepts below.

The wealth counseling process is most effective when family leaders crystallize and articulate a clear vision and statement of core values. A wealth counselor can help translate the vision and values into a mission statement and then help execute the mission through a proven planning process involving all planning team members. Along the way, the wealth counselor integrates the technical skills and process knowledge in a way that respects relational dynamics.

The wealth counselor will frequently assume leadership in guiding a team that helps a family realize its vision and uphold core values. This leadership requires team members that equip each key employee of the family business or heir to the family wealth with the skills needed to perpetuate the family's vision and values. While focusing on the over-arching needs and vision of the family, the wealth counselor must show appropriate sensitivity to each individual in the family system.

Certified Wealth Counselors need relational and technical skills spanning twelve functional areas. To serve individuals and organizations effectively, wealth counselors must understand the tools and techniques necessary to, 1) identify resources; 2) encourage visionary teamwork; 3) choose team members with technical, relational and process skills; 4) define professional engagements; 5) plan with a systematic formal process; 6) communicate the plan; 7) develop a blueprint; 8) understand dangers inherent in money; 9) preempt conflicts that undermine wealth building; 10) resolve conflicts; 11) clarify client relationships; and 12) reaffirm the family's vision. The following twelve sections explain more.

- Identifying Resources The wealth counselor helps clients make optimal use of all their resources to realize a compelling vision. Instead of focusing on just the opportunities created by money, the wealth counselor unites family members around a vision for realizing opportunities created by seven types of resources, including:

- Spiritual insights. The most effective planning often beings with prayer. Every professional advising a client must have a clear sense of how God is guiding him or her to use his or her calling, skills, and training to serve the client. One person on each planning team should know how to help each client prayerfully discern and develop unique abilities to serve others. The wealth counselor can often provide exceptional value by inspiring the client to work with spiritual mentors to discern and articulate a purpose statement, decision-making process, priorities and principles, provision for heirs, and pathway into the future. Efforts to articulate clear plans in these areas may initially reveal conflicts; however, prayer can resolve internal conflicts in ways leading to great clarity. As advisers and family members all seek unity using a spiritual process, they can develop a common language. Then nothing they plan to do will be impossible. (See, e.g., Genesis 11:6).

- Emotional passions. Effective advisers help clients understand and pursue their deepest desires and highest dreams with passion. This is the hope and prayer for each client: "If you are in touch with your driving passions, you will have the inspiration to pursue your calling, develop your knowledge, sharpen your skills and talents, and leverage your resources. As you pursue your passions, you will develop a compelling sense of purpose. As you pursue this purpose, you will see new and unique ways to access and exploit resources creatively and productively."

- Intellectual capital. Intellectual capital includes methodologies, systems, and unique ways of building or creating. As unique ideas are put on papers or otherwise externalized for others, intellectual property ("IP") is developed. IP may include brands, trademarks, copyrights, patents, or other documents with details about proprietary processes. If a client has current or potential income, it is likely that a significant portion of this income can be attributed to IP. Advisers should help clients identify, document, protect, and monetize this IP appropriately.

- Physical talents. Assessments of the unique abilities of each individual should review physical talents. Such talents may include natural abilities to speak, perform, or complete tasks. Inherent skills should be developed through coaching or other professional training.

- Social networks. As each individual focuses on his or her calling, passions, intellectual capital, and talents, a plan should start to crystallize for using these resources. Ideally a plan should include models who have already had success in similar pursuits as well as mentors who can help individuals use unique resources in fulfillment of a customized plan for success. Through social networks, it is often possible to identify and form relationships with models and mentors.

- Professional training. Mentors and other loved ones will often encourage an individual to develop unique resources through professional training. When unique skills are combined with appropriate training, any individual can develop world-class expertise. Of course, such expertise is much more valuable than money. As King Solomon wrote, "Do you see a man skilled in his work? He will serve before kings; he will not serve before obscure men" (Proverbs 22:29)

- Financial capital. Monetary assets are in many ways the least important of the seven resources that God provides. Nonetheless, financial assets are a gift that each individual must steward. Unless financial planning principles are provided diligently, it is too easy for anyone to lose wealth to taxes, creditors, caregivers, or irresponsible family members. Technical expertise is required to minimize exposure to these risks.

- Encouraging Visionary Teamwork

- Choosing Team Members with Technical, Relational and Process Skills

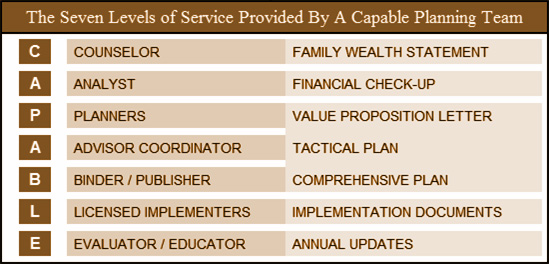

- Defining Professional Engagements The wealth counselor works with the planning team to clients at seven levels. To communicate value delivered at each level, the wealth counselor should oversee production of a valuable deliverable that clearly displays how the benefits at each level are greater than the costs.

- Planning with a Systematic Formal Process When a family is engaged in maintaining or building wealth across the generations or across the branches of the family tree, they face many challenges related to analyzing opportunities in light of threats, exploiting strengths while managing weaknesses, pursuing a vision and mission while holding to appropriate quarterly objectives, and keeping the team focused on realizing objectives while helping each individual pursue the right strategic initiatives and tactical "to do" lists.

- Communicating the Plan

- Developing a Blueprint

- Understanding Dangers Inherent in Money

- Preempting Conflicts that Undermine Wealth Building

- Neglecting to assess all resources available to the client. Without proper wealth counseling, a family will typically have heirs who over-estimate or under-estimate assets available to them. Usually the heirs will not appreciate the sweat, blood and tears expended in the accumulation of wealth. Beneficiaries may even resent how relationships were compromised in the pursuit of financial gain. Lack of openness about each family member's current and expected share of wealth invariably leads to conflict; however, premature openness can lead to inappropriate discussions about wealth.

- Failing to clarify all critical dimensions of the client's vision. A family vision will not unite unless the members of the family see how they are fulfilling their unique purposes when helping to realize the family vision. Low self-esteem or a lack of self-confidence indicates that a wealth counselor needs to spend more time cultivating a deeper commitment to purpose. Moreover, if spouses or business stakeholders are not in agreement about vision, a wealth counselor should lead discussions about the purposes of wealth.

- Underestimating the importance of uniting a planning team with the eight essential capabilities. If clients hesitate to work with an advisory team, invariably the resistance is rooted in bad prior experiences with professional advisers. Fear and trust is usually rooted in lack of confidence that the advisory team members have a transparent process to unite all necessary professionals around cost-effective fulfillment of the client's vision. In short, hesitancy to work with an advisory team is usually rooted in a lack of proven principles and procedures to guide the governance process.

- Reflecting the client's key principles and priorities in legal documents and financial budgets. It is impossible to develop an effective plan without ranked and quantified principles and priorities. Unless a family can rank its most important principles, advisers will not know how to select, design, and draft legal instruments that most effectively honor the principles. Unless goals are ranked and quantified with specific parameters for paying money to the right people at the right time, miscommunication will result.

- Lacking the technical competency to customize, illustrate, and integrate the appropriate combination of planning instruments. The majority of family wealth conflicts probably stem from actual or perceived inequalities in wealth transfer. It is extremely hard for the patriarch and matriarch to draft legal instruments to transfer the right assets to the right people at the right time. Moreover, even if assets are transferred in a fair and equitable manner, transferring control, management, and cash flow raises additional challenges. Should the family succeed in uniting decision makers to make transfers at the right time in the right way, it remains very likely that spouses, children, or advisers will second-guess the decisions without having enough information to make informed comments. Strained relationships will result unless the family systematically thinks through a myriad of issues involving the transfer of proper transfer of wealth.

- Disregarding the importance of preparing beneficiaries to use wealth. King Solomon warned, "An inheritance quickly gained at the beginning will not be blessed at the end." Heirs given money typically have a strong inclination toward spending the money on possessions, pleasures, or other purposes without lasting significance. Psychologists specializing in "sudden wealth syndrome" acknowledge that heirs, like lottery winners, tend to blow their windfall. For a review of many articles and studies related to how heirs tend to dissipate the value of an estate and also lose the values that helped accumulate the wealth, see http://tinyurl.com/WealthLost.

- Resolving Conflicts

- Identifying and developing potential resources. Family members must know how to develop their most valuable resource: the calling given by God. Pursuit of this calling opens up myriad opportunities to serve others, build teams, and acquire wealth. As money accumulates, so do the responsibilities of wealth. Families must know how to discuss balance sheet values appropriately with advisers and other family members. A trained wealth counselor will know how to help each family wealth beneficiary understand the responsibilities attendant to his or her interest in family wealth.

- Clarifying purposes and vision statements. Families must understand the tremendous power of purpose. In his book, What They Don't Teach You in the Harvard Business School, Mark McCormack documents how 1979 Harvard MBA graduates benefited from having a clear statement of purpose. MBA students were asked, "Have you set clear, written goals for your future and made plans to accomplish them?" Only 13% had goals, and only 3% of the graduates reported having written goals and plans. 84% could not articulate specific goals. When all of these students were interviewed again ten years later, the researchers found that the 13 percent of the class with clear goals were earning approximately twice as much as the 84% who could not articulate clear goals. The 3% with written goals were earning approximately 10 times more than the other 97% combined.

- Uniting advisers around a prayerful governance process. Boswell quoted Samuel Johnson as saying, "Sir, I am a friend to subordination, as most conducive to the happiness of society. There is a reciprocal pleasure in governing and being governed." Experience in family wealth counseling teaches that sound governance is conducive to the happiness of families and family businesses. Nonetheless, the wealth counselor must understand how governance principles apply differently in family leadership and business leadership. Appropriate principles must be reflected in operating agreements, trust documents, and other formal statements, compacts, or covenants that guide decision-making.

- Ranking and quantifying priorities; respecting principles. Only with clear priorities will a client know how to bridge the gap between the current situation and the envisioned future. Prioritized goals allow planning team members to unite and realize tangible payoff as well as the emotional satisfaction of helping clients live in harmony with vision statements and values statements.

- Aligning dispositive provisions with faithfulness. When asked how to distribute ownership and control among beneficiaries, experienced planners will often remark that "fair is not equal and equal is not fair." Unpacking this statement and applying it to wealth transfer decisions requires wisdom and technical expertise.

- Preparing beneficiaries to perpetuate the prosperity. The family leader should desire that each beneficiary have the wisdom to build, manage, and transfer wealth at the right time to the right people. This is challenging, given how it is hard to accumulate wealth, harder to maintain wealth, and hardest to give away wealth prudently. Transferring wisdom and resources across the generations requires careful preparation to avoid conflicts about appropriate financial maturity objectives and training programs for beneficiaries of different ages.

- Clarifying Client Relationships

- Reaffirming the Family's Vision Across the Generations

When more financial capital is needed, a client can often generate additional funds by avoiding unnecessary taxes. To preserve and grow wealth, advisers must minimize taxes. Clients typically need a tax law firm that understands estate optimization (when choosing and customizing tax-efficient trusts) as well as an investment advisory firm that understands portfolio optimization (when funding trusts with tax-efficient investments). The law firm and investment firm must work in a coordinated fashion while preserving the attorney-client relationship, upholding high fiduciary standards, communicating clearly with the client, and documenting how the tax savings are much greater than the costs of the planning.

An effective planning team should have experts who know how to develop all of the above sources of wealth for realization of the family vision while upholding the family's values. Obviously, this requires a deep knowledge of technical and relational skills as well as a proven process for uniting the technical details in the head with relational ideals in the heart.

While many variables will change throughout the planning process, vision must remain constant. Leonardo da Vinci wisely commented, "He who is fixed to a star does not change his mind." The wealth counselor must therefore focus first on helping the successful family articulate the vision that guided the success. This vision statement can then serve as a guiding light to keep planning team members aligned.

The vision statement will shine brightest if it is articulated after deep reflection on spiritual insights, emotional passions, and other inspiration that has guided past success. The wealth counselor will usually start discussions about vision in private meeting with the family patriarch and matriarch. Even if these family leaders do not have a clear written vision statement, the wealth counselor can usually discern and clarify the vision during a discussion about events that helped the family achieve success in building wealth and strengthening relationships. The most compelling vision statements typically involve serving people while pursuing a calling, using unique skills, and following proven teamwork principles.

The success of family leaders should inspire others in the family to clarify a vision that can inspire continued success across the generations. The wealth counselor can stimulate the vision-casting process by helping each family member reflect on emotional passions. The wealth counselor can then provide coaching to help each family member apply spiritual insights in pursuit of a calling based on deep desires and timeless values. The wealth counselor may also catalyze success by helping family members identify and properly exploit intellectual capital, physical talents, social networks, and professional training. While encouraging use of the many resources available to a client, the wealth counselor must guard against letting the availability of financial capital distract a client from fully developing non-financial resources.

An individual using all of his or her resources to fulfill a vision will invariably have opportunities to build a team focused on realizing the vision. Team-building should focus on helping family members work together in harmony. The teamwork may involve gathering periodically for fun family meetings. More often, the teamwork occurs as family members meet for board meetings or governance meetings. Most often, however, the teamwork entails perpetuation of family wealth through unified actions of advisers and family members who build investment portfolios, family businesses, and family foundations across the generations.

Financial resources often grow exponentially when non-financial resources are first cultivated appropriately. The growth provides the satisfaction when family members and the advisers work together in unity in pursuit of a common vision. The successful pursuit of the vision requires the technical, relational, and process skills discussed in the next section.

An effective and efficient planning process typically involves advisers with the twelve types of skills listed in the table below. The planning team may have fewer than twelve members when particular advisers have proven skills in two or more areas below.

The client and team should affirm one adviser as a lead adviser. The lead adviser should then assemble a team with professionals that fill complementary roles. The lead adviser needs the relational, process, and technical knowledge to integrate ideas from all team members into a clear written plan focused on fulfilling the client's vision.

| Counselor at Law | Designs and drafts state-of-the-art legal documents that reflect the client's values. |

| CPA | Reviews and audits balance sheet and cash flow summaries in planning documents. |

| Insurance Professional | Designs insurance strategies that accomplish planning objectives to achieve risk management, cash flow, and/or tax efficiency goals. |

| Investment Adviser | Designs, implements, and manages investment strategies to optimize portfolios in conjunction with optimizing estate plans. |

| Pastor/Priest/Rabbi | Confirms that planning goals honor spiritual ideals important to a family and its religious community. |

| Philanthropic Planner | Develops and implements a strategic charitable giving program to realize clearly articulated family values. |

| Plan Administrator | Administers retirement plans, insurance trusts, and other instruments that require careful attention to administrative formalities. |

| Relationship Manager | Reduces complex strategies into an understandable summary of desired outcomes and time-bound next actions assigned to specific team members. |

| Tax Adviser | Provides advice about current Internal Revenue Code provisions throughout the planning process. Integrates charitable and non-charitable tools. See www.ZeroTaxPlan.com. |

| Wealth Coach | Assembles, organizes, and manages the unique talents of planning team members to achieve strategic planning objectives. |

| Wealth Counselor | Unites spouses or family members around a clear statement of vision and values while clarifying goals that guide the planning process. Will often serve as the lead adviser. |

| Wealth Design Adviser | Initiates creative financial, legal, insurance, investment, and tax planning ideas that accomplish specific planning objectives. Summarizes ideas in a Family Wealth Blueprint® or similar document with integrated flowcharts, cash flow projections, and summaries of legal documents. See www.FamilyWealthBlueprint.com. |

Families trying to minimize taxes, transfer assets, or achieve other wealth planning goals will usually hire an expert to give technical answers. This is good; however, the technical specialist will typically only be effective if a process consultant clarifies roles and goals of advisory team members while maintaining controls that insure appropriate use of the expert information. Both the technical expert and process consultant need strong relational skills or the support of a team member who knows how to explain arcane knowledge and/or procedural paradigms in a manner that reflects the family's vision and acknowledges relational dynamics.

A trained wealth counselor will often have an integrated understanding of relational and procedural aspects of wealth planning. The wealth counselor can therefore work effectively with family members to identify core issues rather than just the presenting issues that might distract technical experts. The wealth counselor can serve an entire family instead of just the one person who might engage the technical expert. The wealth counselor can focus on solving problems and achieving goals instead of just logging billable hours. Perhaps most important, the wealth counselor can look beyond narrow definitions of success used by too many technicians; instead, the wealth counselor helps define success in a way that helps the client retain control and ownership of the wealth planning process.

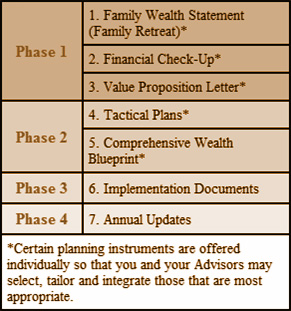

The above seven levels correspond to four phases. The four phases are explained here:

The above model explains how Phase 1 of the CAPABLE process begins with a discovery session. Phase 1 can be completed in just an hour or two if the client has clarity about his or her goals and his or her current situation. In most cases, however, clients welcome assistance in clarifying their goals during a family retreat that leads to production of a Family Wealth Statement. Many clients also appreciate having their current plans analyzed to see how the current plan fails to achieve goals clarified in the Family Wealth Statement. The current plan is analyzed in a document known as a Financial Checkup.

Phase 1 culminates with a Value Proposition Letter ("VPL"), which sets the stage for the second phase. The wealth counselor adapts the VPL to the client's needs. If the client just wants to reduce taxes or achieve some other specific goal, the wealth counselor immediately discusses a relatively simple tactical plan or executive summary plan. If the client wants a more comprehensive process, the wealth counselor discusses a process that produces a comprehensive Family Wealth Blueprint®, which illustrates an optimal combination of strategies for minimizing taxes, increasing transfers to heirs, enhancing charitable giving potential, or achieving other personal or financial goals. Regardless of what services and deliverables are proposed, the VPL must show how the benefits are much greater than the costs.

The seven types of advisors depicted on the previous slides produce seven types of deliverables. These deliverables have been summarized on a timeline. The timeline spans four phases, as shown on the following slide. Ideally, the client will complete each phase before moving to the next phase.

The deliverables created during each phase are adapted to the history, needs, and desires of each person served. Usually the 1st generation will engage the wealth counselor to clarify vision and help execute a plan. The systematic execution of strategies will, however, often deemphasize important emotional and relational issues. The wealth counselor should maintain good relationships with each person affected by the plan in order to spot potential dissonance that can undermine the effectiveness of the family leaders.

As the wealth counselor gains passport to work with the 2nd and 3rd generation, issues will arise that require a process different from that used for generation 1. The generation 2 and 3 heirs may have only a nascent understating of how they identify their callings, clarify their purpose statements, and build teams of professionals to assistant with financial, tax, or legal affairs. Many generation 2 and 3 family members will value coaching about how they can pursue unique roles while respecting the family system. The wealth counselor can serve as a neutral and confidential adviser who can facilitate communications.

Generation 1 will often invest substantial time in designing, drafting, and funding legal instruments during phases 1, 2, and 3. Generation 1 may also establish a phase 4 process for equipping the next generation to understand and perpetuate the family's vision and values. As future generations grow, they may need to go through all four phases anew in order to adapt plans of generation 1 to changing goals, asset values, and tax laws.

As any MBA student knows, accumulating wealth requires a systematic formal planning process to review Weaknesses, Opportunities, Threats, and Strengths ("WOTS") while clarifying the Mission, Objectives, Strategies, and Tactics ("MOST"). This process is explained more at www.WOTSMOST.com.

The strategic planning process helps leaders of a team define a pathway into the future. The pathway is comprised of the career paths of the team members. The best leaders help each manager in an organization clarify how their personal calling and dreams can be fulfilled through career pursuits. A trained wealth counselor can facilitate this discussion about how deep dreams and desires might be realized through development of opportunities within an economic organization.

Through wise instruction, the wealth counselor helps leaders actualize their vision in a way that fosters productivity, economic remuneration, and non-financial rewards. Whereas the traditional strategic planning process may focus on monetary indicators, the wealth counselor knows how to encourage a planning process that encourages services to others, contribution to teamwork, and other non-financial indicia of success. The wealth counselor looks beyond salary and financial benchmarks of success to help individuals execute a plan that results in spiritual fulfillment, emotional maturity, and inner peace.

The wealth counselor should integrate the planning instruments into a plan that displays all current and proposed planning tools on one flow chart. Clients need to see planning instruments depicted graphically to grasp how the components of a plan work in harmony. Once the plan is clear, the wealth counselor needs to communicate the plan to all relevant advisers and beneficiaries.

Too often families will be pressured by an adviser to implement a planning strategy without understanding how the new strategy integrates with existing planning instruments or other proposed planning tools. To resolve this pressure, an adviser recommending a strategy should explain the strategy with pictures, text, and numbers. Each tool must be depicted with a flowchart, a summary of cash inflows and outflows, and bullet points summarizing the legal documents. Only if each strategy is explained in this way will it be possible to communicate how the strategies integrate together.

To test whether planning strategies are communicated clearly, clients and advisers should confirm that all advisers on the team can clearly articulate the family's vision and values. Values must be summarized in ranked and quantified lists of goals. The goals must then guide the integration of planning tools with careful attention given to the sources and uses of cash. Summaries of cash flow should illustrate lifetime income projections as well as projections of inter vivos and testamentary wealth transfers.

Additional Skills Required:

While serving clients in the six main areas described above, communication challenges and conflicts inevitably develop. In such cases, the Wealth Counselor should know how to apply wisdom in the following six areas:

Communication about planning must begin with articulation of a clear vision. The planning team must see a steady and inspiring image. This process is similar to how an architect will have an artist create and display a beautiful artistic rendering of a proposed building before the architect reveals all of the pages of technical details in a blueprint.

Behind any beautiful structure are pages of black and white technical documents. The accountant needs to review pages of financial statements to confirm that the structure makes economic sense. The lawyer must draft and analyze volumes of legal documents to describe the relationships among investors, tenants, and other parties involved in constructing the structure. The project manager will likely have thousands of next actions that clarify completion timelines for tasks assigned to dozens of people. The contractors will need blueprints on the construction sites at all times to confirm that subcontractors are respecting details in all the fine print.

The architect can only see his vision become a reality if he first helps technicians translate multi-faceted and beautiful concepts into the technical details on written documents. Likewise, a composer can only hope to hear an orchestra play the beautiful music in the composer's head after the music is first reduced to black and white notes on a score. Similarly, a skilled wealth Counselor must develop a clear set of documents to unite planning team members much like the architect tries to clarify plans for plumbers, electricians, stone masons, and other subcontractors.

The wealth counselor knows that spouses or other family members have different perspectives. Therefore, it is important that the wealth counselor continue to refer back to a statement of vision or values that will unite decision makers around a shared understanding of the structure being created. At the same time, the wealth counselor must know how to translate the vision into financial statements, legal documents, project management timelines, or flowcharts that will guide technicians.

A Family Wealth Blueprint® ("FWB") is designed to articulate the vision and technical details in one document. The FWB displays lifetime income statement and balance sheet numbers in a format that can easily change in responses to changing goals, tax laws, cash flows, and/or asset values. Using the FWB projections, the wealth counselor can helps clients and advisers unite around a shared plan for minimizing taxes and maximizing resources available throughout each family members' lifetime so that each family member can pursue his or her vision with freedom and confidence. Translating the vision into specific technical details helps a family pursue a satisfying plan for leaving a meaningful legacy across the generations. For more information, see www.FamilyWealthBlueprint.com.

The blueprinting process described above shows how a family will generate revenue and track cash flow. This need to track financial capital is reasonable as long as the focus on money does not distract team members from using other God-given resources in pursuit of the team's vision.

When more financial capital is needed to help build a team, a wealth counselor can provide recommendations based on knowledge of financial and tax planning instruments. Frequently new resources come from tax savings attendant to using advanced planning instruments that reduce income taxes (including ordinary, capital gains, and AMT taxes) while minimizing or eliminating transfer taxes (including estate, gift, and GST taxes).

Capable wealth counselors can suggest a myriad of ways to generate more cash flow. Having more funds is fraught with risks. While many heirs seemingly believe that money will buy happiness (or relief from stress), statistics suggest otherwise. Unless the beneficiaries of wealth are well trained to budget, invest, and manage wealth, any new wealth can be as tempting as a windfall from a lottery winning. Money that is not earned is usually not valued as it should be. Too often the challenges of managing unearned wealth result in the wealth recipient having more struggles and heartaches than what existed before the money was received.

Managing cash requires diligence, focus, and self-discipline. More important, anyone with significant assets needs strong relationship and communication skills to choose, monitor, and manage advisers who help maintain or grow the wealth. Too many inheritors learn the hard way that it is hard to accumulate assets, harder to maintain assets, and hardest to grow the assets across the generations.

The wealth counselor needs to review what the client has said about retirement security, transfers to heirs, charitable giving, and other key planning issues. The process of articulating the priorities often reveals that the husband and wife have not come to full agreement. For example, a husband will frequently approach planning as a "chief executive officer" who is very focused on cash flow, taxes, and net worth. His wife, on the other hand, may be a "chief emotional officer" who understands relational dynamics that the husband cannot easily address in the business financial statements and strategic plan. Said another way, the wife often wants security in the business so she can focus on growth at home, whereas the husband often wants stability at home so he can focus on growth at the business. Even if these husband and wife stereotypes are not true in your situation, it is likely that your family members do not agree fully about wealth planning issues. Your family members may all have wonderful ideals, but your advisers need to find a way to harmonize competing interests before they can build anything on a firm foundation.

Too often, the initial excitement about planning dissipates for reasons that are not clearly articulated. As soon as an advisory team sees a lack of follow-through on commitments to complete planning assignments, advisers should look for signs of conflicts.

Conflicts manifest in three main areas: conflict with God, conflicts with self, and conflicts with others. Problems with God are likely when an individual refuses to honor spiritual principles that a family has prayerfully defined and practiced over the years. Conflicts within self may manifest when an inheritor receives a sudden transfer of wealth, whether expected or unexpected. Internal tensions can grow worse as a wealth beneficiary realizes that wealth, whether earned or unearned, does not provide the emotional satisfaction, social status, or other anticipated trappings of success. Ultimately, the internal conflicts with God and self manifest as relational problems visible to family members. Personal problems often result in withdrawal or moodiness evident as family members and advisers seek to involve the conflicted person in the business, tax, or financial planning process.

When a family member seems too conflicted to participate in a constructive wealth planning process, astute advisers "peel the onion" to identify core assumptions that need to be clarified before planning team members can be in agreement. Analysis of the presenting issues regarding taxes and finances frequently leads to discussions about much deeper emotional, relational, or spiritual issues.

As discussions about wealth planning go deeper, the wealth counselor often uncovers disagreements (often emotionally-charged) about how legal documents and business instruments should be designed, drafted, and funded. The conflicts are not about the presenting issues but about deeper conflicts that tend to fall into three areas: (a) spouses disagree about which heirs should receive which assets at which time; (b) business partners disagree about the transfer of management, control, ownership, and cash flow; or (c) professional advisers disagree about how to overcome their conflicts of interest, competition for control, or differing professional recommendations.

When a wealth counselor "drills deeper" to the core of a conflict, he or she often finds that lack of agreement among spouses, business associates, heirs, and/or adviser team members is related to different foundational principles and priorities. For example, spouses and business partners, if pressed for specifics, will often have different beliefs about liquid reserves, cash flow management, expense control, debt ratios, and other foundational issues.

Unfortunately, the onion peeling process frequently shows that money is at the root of evil motives and counter-productive behaviors in six main areas. When plans remain unclear, unimplemented, or unworkable, the wealth counselor should peel the onion to examine with relational problems are rooted in these core issues:

Wealth Counselors frequently help family businesses address issues related to differentiation of the individual and the clarification of unified roles of individuals on a team. The process begins with helping the family leader crystallize and articulate a clear vision and mission. A good leader will translate the mission into quarterly objectives and strategic initiatives that guide task lists. This process typically leads to triangulation as subordinates seek to circumvent the leader's directives or second-guess decisions. The wealth counselor must be equipped to identify and address subversive behaviors.

The six chapters of this book address the six problems in the previous section of this appendix. In fact, it is possible to address all types of problems with family wealth leadership if there is a process that clarifies clear standards in the six areas summarized here:

When not all family members support the vision articulated by the family leader, it is necessary to "peel the onion" in the six above areas to find why dissension exists. Peeling the onion invariable reveals how not all family members or advisers agree about principles and priorities guiding the family. Such conflicts are rooted in different presuppositions about what is most important in life. These discussions about presuppositions lead to reflections about God and his purpose for creating us. Ultimately, therefore, all wealth planning decisions have roots in how we interpret God.

The wealth counselor handles dissonance differently depending on whether conflicts are rooted in peace-faking, peace-breaking, or peacemaking. Peacemaking conflicts can actually be good because they stimulate healthy discussions about each individual's roles, goals, controls, and work flows. For more information about a God-honoring process for resolving disputes, see http://tinyurl.com/SlipperySlopeSolutions.

The above paragraphs raise issues affecting everyone with wealth and many of their relatives and business associates as well. Probably everyone is in some way affected by the challenges of identifying, managing, budgeting, giving, or otherwise stewarding wealth. Which of these people need to hire a wealth counselor?

Wealth counselors typically engage the family patriarch and matriarch. Nonetheless, they can also help business partners in transition, families struggling with new wealth, or beneficiaries preparing to inherit assets. A relationship with a wealth counselor can help all of these people define goals, clarify plans, build confidence, improve communications, develop trust, and unite team members in pursuing an inspiring vision. The wealth counselor can reaffirm a vision while helping individuals find a purpose consistent with the vision.

A trained wealth counselor knows how to define the engagement with a client in a way that focuses necessary experts on fulfilling the client's paramount relational goals. The wealth counselor should have the skill to coordinate technicians and process consultants. When a team of seasoned professional is convened, the wealth counselor must help each receive reasonable compensation while always communication to the client how the cost of the team is much less than the benefits being realized. For families the majority of families with concerns about the economics of hiring outside experts, the wealth counselor must have proven skill in communicating the value propositions of professionals to convened to help a family.

Most important, however, the wealth counselor adds value to the client relationship by affirming the family vision and helping each client understand his unique roles and goals in fulfilling the vision with passion. The wealth counselor draws on relational skills to provide mentoring, wisdom, and inspiration for each family member who needs help in developing practical action steps to realize his or unique purpose.

Ideally, the wealth counselor can lead family meetings and individual sessions with family members to help each member of a family find meaning and purpose in the process of accumulating, maintaining or giving wealth. Nonetheless, the wealth counselor will encounter many frustrated parents or spoiled and disobedient heirs. Unique technical, process and relational skills may be most important in these negative situations.

The most successful wealth counseling engagements often involve numerous private meetings with family members. In the private consultations, the wealth counselor can uncover hidden agendas, festering fears, or a myriad of other actual or potential "elephants in the living room." Until a family has a workable plan to fulfill a clear vision, decision makers may meet with the wealth counselor weekly. If there are geographic limitations, meetings often occur via webinar. During web-based seminars, the wealth counselor reviews diagrams and documents while webinar participants virtually look over his or her shoulder.

A family with strong visionary leadership may already have internal staff providing all of the above skills and services. Nonetheless, the advice of an experienced wealth counselor can often help a family leader sharpen visionary leadership skills in a way that helps the family build unity throughout branches of the family and across the generations.

As much as $136 Trillion will transfer to the younger generation during the next 50 years. Studies show that heirs receiving this wealth will in most cases make poor use of the money and fail to carry on the vision and values of the people who created the wealth. Fortunately, families can overcome wealth transfer challenges and leave a meaningful legacy if they have guidance from a Certified Wealth Counselor.

Families will often first approach a wealth counselor for help with taxes or other financial problems. Dysfunction among heirs or other family members will often drive people to the wealth counselor's office as well. The Certified Wealth Counselor knows how to turn negatives into positive. Using proven skills, a trained and competent wealth counselor can help select, equip, hire, motivate, and evaluate the right advisers to help a family address basic relational and technical issues associated with the accumulation, maintenance, or transfer of wealth.

Families that employ a Certified Wealth Counselor effectively can usually show millions of dollars of tax savings and other financial benefits. More important, the Certified Wealth Counselor can go beyond quantitative indicators of success to help family members experience the hope, joy, and other types of self-fulfillment attendant to developing financial maturity. By working with a Certified Wealth Counselor to establish the right technical, procedural, and relational processes, a family can experience the satisfaction of seeing growing asset values and deeper core values pass effectively from generation to generation.