| |

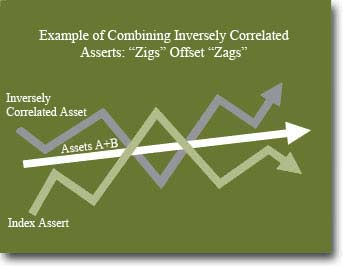

Real portfolio returns have been reduced dramatically by inflation over the last 80 years. History teaches that some asset classes perform poorly during times of inflation; other asset classes perform well. You need asset classes that can generate positive returns when inflation is causing many investments to perform poorly. In this way, the inflationary "zigs" in your porftfolio offset the "zags." In short, you can earn stable returns regardless of the inflationary pressures affecting market returns. More important, you can avoid the loss of purchasing power shown in the historical return bar chart to the left.

Past performance is no guarantee of future returns.

|