|

|

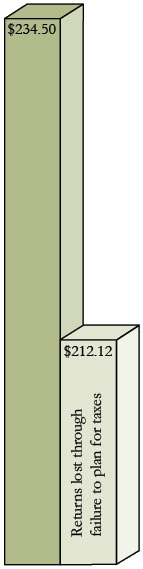

Portfolio Optimization Can Help You Maximize Your Returns After Taxes |

After

Inflation

Return |

After-Tax

Return |

|

|

| |

Tragically, the amount left for heirs can be as little as 10% of the initial amount if we fail to take into account estate and gift taxes (as high as 46%), capital gains taxes (23% in California), income taxes on interest (over 40% in California), IRD taxes, AMT taxes, and various corporate, excise, property, and sales taxes that can lower returns.

Therefore, wise investors understand the critical importance of having investment advisers work along side tax advisers to minimize taxes on investments. We believe very strongly in having your portfolio monitored by both your Registered Investment Adviser and your tax lawyer. | | |

|

|